Autumn Budget 2025 – from headlines to reality.

Written by

Edward Ullathorne

10 min read

Updated - January 27, 2026

What was trailed, what was dropped, what was announced and what has happened since?

With the benefit of hindsight, the Autumn Budget 2025 now reads less like a single fiscal event and more like a prolonged period of policy signalling, retrenchment and quiet recalibration. In the months leading up to the Budget, a wide range of radical measures were trailed, many of which were ultimately abandoned before Budget Day itself. Others emerged only after the event, including material changes announced just before Christmas that fundamentally altered the inheritance tax landscape for farm and business owners.

Now, as we move into 2026 and implementation dates approach, the focus has shifted away from political positioning and towards the practical reality of what has actually survived, how it operates in practice, and what it means for taxpayers and business owners going forward.

As with many recent fiscal events, there was a familiar sense that taxpayers and businesses were once again being asked to do more with less. Where the Autumn Budget 2025 was genuinely unprecedented, however, was the sheer volume of measures trailed in the run-up that were quietly dropped, followed by significant policy announcements made weeks later — most notably the pre-Christmas decision to relax proposed inheritance tax restrictions, removing many farm and business owners from the scope of changes originally planned for April 2026.

There was also extensive political positioning in the weeks before the Budget, including the Chancellor’s speech on 4 November, in which government finances were presented as being under acute pressure — a position we now understand was not supported by the OBR’s internal analysis. Whether Rachel Reeves remains Chancellor by the time of the next Budget remains to be seen.

Aside from the income tax changes discussed below, the following measures were widely mooted prior to the Budget:

- A 20% ‘exit’ tax — prompting some individuals to leave the UK earlier than planned

- Restrictions on lifetime gifting — prompting gifts to be accelerated

- Restrictions on the 25% tax-free pension lump sum — prompting early withdrawals

- Bringing LLP partners’ profits within the scope of employer’s National Insurance

- Changes to the operation of main residence relief

- The introduction of a wealth tax

None of the above were ultimately introduced. However, the fact that they were seriously briefed and discussed caused a significant degree of uncertainty across the taxpayer population. Importantly, these ideas have not been formally ruled out and may yet re-emerge in future fiscal statements. Despite sustained campaigning around the so-called “family farm tax”, nothing was announced at the Budget itself; instead, material changes were released separately weeks later. There were clear parallels with the winter fuel allowance episode — and, arguably, echoes of the Liz Truss mini-Budget — with 2026 tax cards issued by the CIOT on 22 December rendered out of date within 48 hours.

What also distinguishes this Budget is the sheer volume of legislative change. In total, 85 separate measures were announced, in what some have politely described as a smorgasbord approach and others as a ‘death by a thousand cuts’. The scale of change will require extensive “out of scope” adjustments to HMRC’s tax processing systems, from which outsourced providers such as Capgemini, Fujitsu and Accenture will no doubt benefit.

This scattergun approach also carries inherent risk. Will all accountants and tax advisers be fully sighted on the changes? Will HMRC be able to administer them effectively without further investment and training? And what of the unintended consequences? In the sections that follow, we consider how these measures are likely to impact taxpayers, businesses and the wider UK tax landscape in 2026 and beyond.

The New Income Tax Regime: rate hikes and fiscal drag.

The main policy that was mooted in the weeks before the Budget was a 2% rise across all income tax rates and a corresponding 2% reduction in the basic rate of employees NICs (and NICs for self-employed). I learned pretty early on in my tax career that State Pension and benefit entitlements are no longer linked to the amount of NI contributions an individual has made but simply the number of years of contributions they have. After paying your first £1 for a tax year, the remaining payments have no impact on your benefits at all – they are effectively just another tax by another name, a “surcharge” on earned income with its own governing legislation.

The original proposal would have been a neat way to reduce that “surcharge” without losing the tax take – and a move towards streamlining income tax and social security.

It would have been increased for dividends, interest, rental income and for higher rate and additional rate tax payers. We didn’t get this, however what we got still reached more or less the same objective of increasing tax for “passive” income but in a more convoluted manner.

There were no changes to the main rates of income tax for ‘earned income’ i.e. employment income, self-employment income and miscellaneous income (such as royalties). However, personal allowances and higher-rate thresholds remain frozen until April 2031, which will intensify fiscal drag as nominal earnings rise, pulling more taxpayers into higher bands.

The following upcoming changes to income tax have been announced:

-

From April 2026 - the basic dividend rate will increase from 8.75% to 10.75% and the upper dividend rate will increase to 35.75%. The additional dividend rate is not being increased but will remain at 39.35%. In previous years such a change being announced might encourage owner managed businesses to pay out a dividend ahead of the increase, and this will still be appropriate in some cases (potentially where trusts are involved), however even with the additional employer’s NI introduced last year, paying surplus profits out as a bonus will usually be more tax efficient than paying a dividend.

-

From April 2027 - the basic savings rate will increase to 22%, the higher savings rate to 42% and the additional savings rate to 47%. Despite this charging loan interest will still be an even more efficient route to extract profits from a business than paying salary or dividend – albeit there are IHT implications to think through with such a set up.

-

Also from April 2027 a new category of ‘property income’ will be introduced - the basic property income tax rate will be 22%, the higher rate will be 42% and the additional rate will be 47% - so the same as savings rates, and so if you have a property that is used by the business then charging rent is also efficient way of extracting company profits albeit again there are other tax implications to think through when it comes to property.

-

The new rates will only apply to income from land and buildings - so rental income from leasing plant or machinery should continue to be subject to the main income tax rates.

-

As announced last year – and with effect from April 2026 - the ‘carried interest’ payments that investment fund managers receive will be subject to tax as trading income (so typically 47%). However, there are two special treatments that can apply:

- Where the funds average holding period is at least 40 months and the AHPC (average holding period condition) is met the tax rate can be reduced by 27.5% to 34.1%

- A new relief introduced at this budget is that for non-UK residents the income tax treatment will only apply where the individuals are performing management services in the UK for 60 days or more. This relief will be most welcome although some will say it does not go far enough.

Following the introduction of a new category of income, we now have an income tax system that appears to comprise 10 different marginal rates of income tax that could apply – and this is before we even get to the ‘traps’ that occur when the personal allowance and child benefits are tapered, or the special rates under the ‘temporary repatriation facility’.

These changes certainly don’t seem to be doing anything to simplify the tax system, but there was a lot of politics at play with this budget and unfortunately keeping lobbyists happy does tend to result in a growing number of specific tax rules and added complexity. Whilst the original proposal would have been much simpler and easier to administrate it would have resulted in a breaking of the strictly worded manifesto pledge to not raise income tax on ‘working’ people.

In addition, because the state pension (untaxed at source) increases due to the triple lock, whilst the personal allowance remains frozen, all pensioners for whom this is their only income are brought into self-assessment. Rather than increase the personal allowance for state pensioners, the government has instead opted to create a ‘simplified tax return’ for individuals that are caught in this way – adding further complexity to HMRC’s tax processing systems and leaving us all wondering where the benefit of this is.

Property Update

The new ‘mansion tax’ surcharge

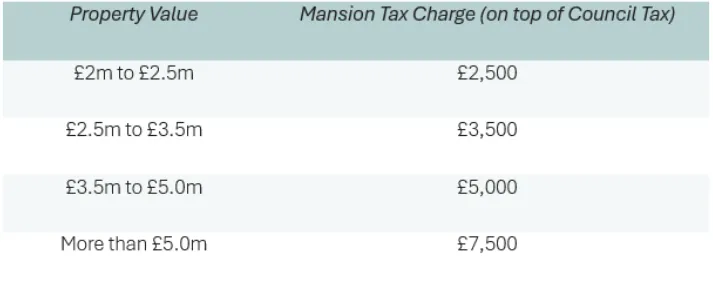

The budget announced that a new council tax surcharge would be introduced for homes valued over £2m with effect from April 2028. This surcharge will be collected by local authorities alongside normal council tax but will be paid to central government. The surcharge only applies to properties within England so valuable Scottish estates are outside the scope – for now at least. The proposed rates are as follows:

There will be a consultation on how the valuations will work, but the surcharge will be based on 2026 values and updated every 5 years – Council Tax is still based on 1991 values and it has been suggested that a possible outcome of the consultation may be to have a unified regime that looks to revalue all properties at 5 year intervals although I suspect the local authorities would not be signing up for this.

It is also worth mentioning that only the dwelling is valued – so if there are substantial surrounding grounds these should be ignored.

As the surcharge will be calculated depending on what “slab” a property falls into – rather than a “sliced” approach like how Stamp Duty Land Tax is calculated – this means there are some hard edges and an extra £1 of valuation could take you into the next band and a further £2,500 annual cost. No doubt there will be some valuation disputes around the thresholds and whether the bandings themselves should be taken into account.

The proposed level of these surcharges are comparatively small compared to the property values themselves and therefore could be stomached by most homeowners. The real concern is that now this tax has been introduced the Government will do it’s trick of increasing the charge each year (whilst keeping the bands frozen). If we look at the ATED charges for corporate owned private residences (that was also dubbed the “Mansion tax” when it was first introduced), these charges have more than doubled since they were originally introduced in 2013/14.

Updates to Excluded Property rules

There were two points to be wary of for those with overseas connections that are subject to the excluded property rules.

The first is a transitional rule that applies to trusts that held excluded property at 30 October 2024 and were then brought into the scope of Inheritance Tax charges in April 2025. The new rule caps the ten year charge liability for such trusts at £5m. Given that the maximum rate of this charge is 6% this rule will only apply to single trusts that hold over £83m.

Given the position the Labour party have set out to ‘abolish’ the non-dom regime it is not unsurprising that little attention has been drawn to this concession for the ultra-wealthy – however the suspicion is that there would have been a few particularly important individuals who requested this cap.

More cases will be impacted by the other announcement concerning Excluded Property, which is that - with effect from 6 April 2026 - interests in UK agricultural property will no longer be capable of qualifying as Excluded Property.

This will be the case even if the interest is structured through a non-UK company or as a loan used to finance the acquisition of UK agricultural property. The new rules are much like the rules introduced in 2017 for interests in UK residential property. Furthermore anti-avoidance provisions have been brought in that prevents such interests from qualifying as excluded property where they are distributed from the trust after 26 November 2025 – although Agricultural Property Relief may be in point in any event.

IF YOU ARE AN EXCLUDED PROPERTY TRUST – OR A NON-UK RESIDENT - WITH INTERESTS IN UK AGRICULTURAL PROPERTY YOU SHOULD BE REVIEWING YOUR INHERITANCE TAX POSITION NOW..

MTD: Making Tax Digital Difficult for Renters

Finally, from April 2026 landlords with gross rental income in excess of £50,000 per annum (before expenses) will be brought into the scope of Making Tax Digital. What this means is that you will need to complete and submit quarterly returns. Speak to your tax advisor if this impacts you.

Business Update

When it comes to being asked to do more with less, businesses are the ones that have faced increasing pressure on staff costs. Even before we got to the pension changes announced in the latest budget, businesses are still feeling the effects of April 2025’s increase in the rate of Employer’s national insurance to 15% and the increase to National Minimum Wage rises from April 2026, including £12.71 for workers aged 21 and over, with larger percentage increases for younger bands.

It is worth noting that directors are exempt from minimum wage rules – so a director looking to draw a salary £12,570 does not need to cap their time at 19 hours a week to avoid a breach.

Inheritance Tax

Whilst the Government were adamant they would not U-turn on the new restriction in APR/BPR – the so called “family farm tax” – they did make a concession at the Autumn Budget that the allowance will be transferable between spouses and civil partners, bringing this into line with the treatment of unused nil rate band and main residence nil rate band on death of the first spouse. One wonders why this was not included in the first place.

On 23 December the Government announced that the allowance will not be £1m but rather £2.5m. This means that a husband and wife will have a combined 100% allowance of £5m with anything above this qualifying for 50% relief.

In practice from 6 April 2026 a husband and wife could still settle £6.3m of qualifying assets into trust without incurring a charge – the first £5m qualifying for 100% relief with the remaining £1.3m qualifying for 50% relief, and then the final £650k being covered by nil rate bands – although getting certainty on the value and that the assets do indeed qualify for relief (from both IHT and CGT) will be key.

New rules on pensions

One of the major announcements of the budget was that the national insurance savings offered by employee’s making a salary sacrifice in exchange for employer pension contributions will be capped from April 2029.

From that date onwards only the first £2,000 of contributions made via salary sacrifice will be exempt from national insurance, with the amounts over this subject to both employer and employee national insurance in the same way as salary.

It is worth emphasizing that this restriction is only for employer pension contributions made via salary sacrifice. Standard employer contributions will remain exempt from National Insurance and so any defined benefit schemes (such as civil service schemes) will not be affected. There is already a fair bit of guidance and case law as to when exactly an employer contribution is a salary sacrifice and when it is instead a negotiation of employment contract – however this is an area where we expect will attract more scrutiny from HMRC in future.

Businesses will likely want to take a prudent approach and so may apply national insurance to any contributions over £2,000 – however the knock-on implications will be a mixture of higher staff costs and employees saving less into their pensions.

Reconstructions and incorporations

There has now been a small but fundamental change to rules on share for share exchanges and other restructures – previously these transactions would not give rise to a CGT charge but the new shares would be deemed to ‘sit in the shoes’ of the old shares, provided that the transaction (overall) was effected for bona fide commercial purposes and not for the avoidance of UK tax.

However, the legislation has now been changed such that any transaction done with the purpose of reducing the UK tax liability may fail to qualify for this relief. HMRC say that the new rule will now better target those cases where, as part of a commercial exchange or company reconstruction, additional arrangements have been put in place to obtain a tax advantage.

It is still possible to make an application to HMRC to agree on the treatment and we typically recommend that this is done where time allows. If you have any lives cases please do speak with your contact at Trident Tax.

Other announcements

Other announcements at the autumn budget relevant to business owners included:

- Changes to the rules on selling a company to an Employee Ownership Trust – such sales now only qualify for 50% relief from CGT, whereas previously the sale could be 100% tax free.

- Changes to the capital allowance rules including a new 40% first year allowance for capital expenditure, which could be beneficial where purchases do not qualify for full expensing or the annual investment allowance.

- Increased limits for EMI and EIS

- A Research and Development advance assurance service

- Increased income tax on dividends as noted above.

- A VERY generous settlement regime for those who took part in a disguised remuneration tax avoidance scheme, which we have covered separately in our insight article of 3 December, “Government sets out revised loan charge settlement terms for 2026”.

If you wish to discuss how any of the above announcements impact you or your business please get in touch with your contact at Trident Tax and we will be happy to help.